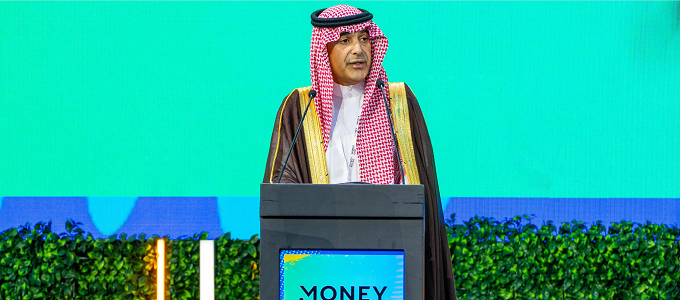

SAMA Governor Keynote Speech at the Opening Ceremony of Money20/20 Middle East

Page Content

بسم الله الرحمن الرحيم

والصلاة والسلام على أشرف الأنبياء والمرسلين، نبينا محمد وعلى آله وصحبه أجمعين

أصحاب السمو والمعالي والسعادة، الحضور الكرام.

السلام عليكم ورحمة الله وبركاته،

I extend my warm greetings to distinguished guests, ministers, industry leaders, and global delegates.

That an event as internationally renowned as Money20/20 is being held here in Riyadh is a testament to Saudi Arabia’s rising prominence as a global hub for financial innovation.

Under the auspices of Saudi Vision 2030, and guided by the Financial Sector Development Program and the Fintech Strategy, Saudi Arabia’s transformation into a leading Fintech hub is well underway.

In my remarks today, I would like to share with you highlights of this ongoing transformation, and offer my perspectives on notable drivers of this momentum.

The extraordinary growth of the sector has been in keeping with our national ambitions and commitment to global excellence:

The sector has experienced a remarkable threefold expansion – growing from 82 Fintech companies in 2022 to 281 as of August 2025 – reflecting the Kingdom's success in enabling robust growth.

It has also attracted market-leading cumulative investments of over 8.9 billion SAR as of July 2025, cementing its status as one of the most attractive sectors for investors.

A highlight of this progress has been the payments ecosystem in Saudi Arabia - now firmly established as one of the most digitally advanced in the world. Electronic payments accounted for 79 % of total retail payments in 2024, while the total number of electronic payments grew to 12.6 billion in 2024, from 10.8 billion in 2023.

This growth is not just a reflection of our ambition, but also of the ability to innovate, and deliver solutions that solve industry challenges.

The successes that the financial sector has achieved to date have leveraged Saudi Arabia's diverse and distinctive competitive advantages:

The Kingdom's geographical location positions us as a gateway to a diverse regional market, connecting the Middle East, Africa, and Asia.

Our nation is home to a large, tech-savvy population with high smartphone penetration, creating a receptive target market for Fintech innovations supported by advanced financial infrastructure.

The regulatory environment is supportive, allowing new solutions to be nurtured, tested and scaled for global impact.

Crucially, SAMA is committed to encouraging the entrance of international innovators through its ongoing efforts to support and invest in the Kingdom's financial ecosystem, while embracing and sustainably scaling up innovative business models.

In particular, partnerships with international payment companies, who have successfully established a presence in the Kingdom, are enhancing the domestic ecosystem by enabling technology and knowledge transfer and providing improved choice and flexibility for consumers while also stimulating economic growth.

Global investor confidence in Saudi Arabia as a safe, attractive, and growth-ready destination continues to be further strengthened, reinforcing the Kingdom's leadership in payment infrastructure.

At SAMA, our responsibility extends beyond oversight we place great emphasis on shaping an environment that fosters prudent innovation while ensuring stability and accessibility.

In proactively supporting the development of the Fintech ecosystem, our objective is to ensure equitable market opportunities, accessible common infrastructure, and the creation of a clear and accommodative regulatory environment.

Through a robust and agile regulatory framework, we strive to protect consumers and the financial system while encouraging the development and application of novel technologies.

Key regulatory initiatives to foster Fintech growth include the Regulatory Sandbox – which has been one of the most successful initiatives of its kind globally, as well as Fintech Saudi and the Makken program, created in collaboration with the CMA.

More recently, SAMA has launched a new e-Services Portal — a unified digital gateway that offers seamless access to SAMA's digital services.

The portal aims to improve user experience and streamline regulatory interactions, ensuring that licenses, approvals, and supervisory oversight decisions are processed with greater efficiency.

SAMA is also investing in advancing critical national infrastructure that underpins the financial services industry. A flagship initiative launched this year is a blueprint for the modernization of the Real Time Gross Settlement System. This effort will support continued financial sector expansion, enhance interoperability and efficiency, while enabling sophisticated vulnerability detection to ensure financial stability.

Check clearing infrastructure is also being upgraded, through adoption of industry-leading standards within the Central Electronic Clearing Centre at SAMA, and will soon enable same day clearing for checks, thus increasing the velocity of circulation of money in the economy and enabling development of new payments use cases.

Regulatory decisions such as SAMA's recently announced clearance for securitization of residential mortgage-backed securities will accelerate market development.

Finally, as market participants globally explore institutional use cases for stablecoins, SAMA and other global regulators are enhancing cross-jurisdictional cooperation to assess risks and enhance financial stability safeguards.

In a world where opportunities and risks transcend borders, we recognize that true progress cannot be achieved in isolation.

Fintech thrives when knowledge, standards, and infrastructure are harmonized, and partnerships ensure that innovation is not fragmented.

Fintech innovations, from instant payments to open banking, are creating opportunities that are inherently cross-border in nature.

Simultaneously, the interconnected nature of the global financial system means that risks can also travel across borders in real time.

Collaboration is therefore the foundation of a safe, inclusive, and innovative global financial system, and will be critical in taking the sector forward.

At SAMA, we are firmly committed to collaboration with our international peers and see these partnerships as fundamental for prudent innovation.

The Fintech industry will continue to set the direction of travel for the whole of financial services. There are many exciting developments on the horizon, from AI through to tokenization, and beyond.

Collaboration will be key to ensuring these new technologies receive the support they need to scale effectively, balanced against the prudence required to maintain financial stability.

I must therefore conclude my remarks by thanking the organizers, partners and attendees for coming together to organize Money 20/20. This event will serve as an important platform for such collaboration – to share the ideas, insights, and experiences that are shaping the future of finance.

As we move forward, we at SAMA remain committed to serving as an open, forward-looking, and trusted partner in Fintech innovation.

Thank you.

Governor

Enterprise Keywords